Machine Learning for Finance

Bridge finance and technology with practical machine learning expertise.

Explore finance-applied machine learning with industry insiders.

Today’s businesses need data-based financial analysis to gain deeper insights that will enable them to connect operations to long-term value, model scenarios in real time, and allocate resources efficiently. The increasing demand for advanced finance functions and technological advancements in cloud-based services have led to the financial analytics market’s significant growth.

The University of Chicago’s eight-week Machine Learning for Finance course focuses on collecting, organizing, and using data to perform advanced financial analysis with algorithms and statistical techniques and tools. You will engage with real-world case studies and examples, allowing you to apply the theory you will learn to financial models.

$74 k

$43 b

15%

Course Modules

After completing the course, you will be able to:

Apply statistics and probability concepts to finance.

Understand what exploratory data analysis is and how to perform it with Python and Pandas.

Engineer new features and functions from existing data.

Comprehend how unsupervised machine learning models work and when they can be useful.

Use simulation to solve portfolio risk and allocation problems and answer financial questions.

Pioneer data-driven strategies that enhance financial forecasting, risk assessment, and investment analysis.

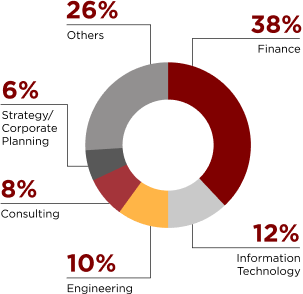

This course is an excellent fit for:

CFOs and other senior finance leaders eager to drive data-centric financial strategies and lead digital transformation in their organizations.

Investors, venture capitalists, and portfolio managers looking to enhance risk assessment and optimize investment strategies using data-driven methodologies.

Consultants who want to integrate advanced machine-learning techniques into financial modeling and decision-making.

Diverse finance professionals interested in leveraging machine learning and predictive analytics to enhance financial performance and decision-making.

Analysts and data professionals looking to transition into finance or specialize in fintech, quantitative analysis, or financial risk modeling.

Unique Program Features

UChicago Credentials

By successfully completing the course, you will receive a credential from the University of Chicago, a digital badge, and earn 4.6 Continuing Education Units (CEUs). You will also become part of the UChicago network.

Meet Your Instructor

These instructors teach this course regularly. Please speak to your enrollment advisor if you wish to know who the current teacher is.

Vice President at an Investment Bank

Clinical Assistant Professor of Operations Management

Student Feedback

Home to 101 affiliated Nobel laureates, UChicago is where learners turn ideas into impact.

Starts on